UX research (aka design research, customer research or user research) has become a defining characteristic of highly successful and profitable startups and companies.

From brands like Nike and Adidas, to direct-to-consumer upstarts like Glossier and Warby Parker, to fintech powerhouse Transferwise, to the FAANG (Facebook, Amazon, Apple, Netflix, Google) powerhouses — the smartest companies on the market today are prioritizing UX research.

This guide was created explicitly for non-researchers: those who know the importance of user research to do their jobs properly or run their companies but haven’t had much experience or formal training in the area.

We’ve broken actionable UX research down into the most beneficial research methods with advice on how to start using them, whether you’re a:

- Product Manager

- Designer

- Marketer

- Engineer

- Customer Successer

- Entrepreneur

- New-to-the-field UX Researcher

Table of Contents:

1. UX Research vs. Market Research

2. Quantitative vs. Qualitative Research

3. What is Actionable UX Research

4. Applying Actionable UX Research

- User Interviews

- Surveys

- Remote Usability “User” Testing

- Onsite/In-App Polling

- Live Chat/Support Ticket Transcript Analysis

- Google Search Intent Mining

- User-Generated Content Mining

- User Session Replays/Heatmaps

- Facebook Audience Insights

Today, UX research can significantly dictate the success of a company.

- A 2016 study of 408 companies found startups investing in user experience research see increases in sales, higher customer retention, higher customer engagement, and faster product cycles.

- A 2017 study found that SaaS companies that did as little as 10+ user interviews a month outpaced their counterparts who didn’t prioritize UX research by 30% annually.

- A 2018 report from McKinsey found that companies that focused on UX and design outperformed growth benchmarks by as much as two to one.

What does all this mean?

It means UX research is a competitive advantage in crowded markets.

It means user research (“UXR”) as a key organizational capability is exploding.

It means that more and more non-researchers (i.e., those in marketing, engineering, product and/or founder roles) will be required to perform UX research as a key part of their roles. A recent user research report from User Interviews stated that 50% of UX professionals report there are more people doing research at their company than there are dedicated UX researchers.

Yet, unfortunately, research and experience continue to show that companies struggle when applying user research effectively in practice costing them time, money, and opportunity costs.

Maybe you remember Coca-Cola unveiling ‘New Coke’ back in the ‘80s. Or maybe you don’t, because you were just a wee tyke.

Either way, New Coke was a complete failure, with mistakes in user design costing the company $4 million in development and $30 million in back-stocked product.

Heinz lost millions for decades designing for the wrong customer. Dropbox had to kill two new product lines because they didn’t do enough upfront research. ClassPass wasted their first 18 months targeting the wrong market.

There are far too many examples of these preventable disasters out there — but isn’t it time to put them to bed, once and for all?

As the field of UX research continues to take off, preventing these mistakes will only happen if non-researchers are taught not only how to do user research, but how to actually use it to make smarter, more well-informed decisions.

We can’t cover everything in a single beginner’s guide, but if you’re wondering how to find actionable user research, here’s a start.

UX Research vs. Market Research

UX research and market research are different.

The easiest way to see the difference? Market research goes wide (think looking at the aggregate), while user research goes deep (think looking at the individual).

Market research often looks at group-based demographic data, while user research goes deep into the details of individual users, extrapolating critical patterns and trends to better understand customers’ rapidly changing needs.

Emphasizing the individual is incredibly important in today’s customer-driven economy: users are inundated with noise, acquisition costs are sky high, and competition is rampant.

UX research strives to surface the voice of the customer and generate valuable insights to drive business decisions, reducing the risk of mistakes and allowing more certainty in planning and strategy across every department.

Quantitative vs. Qualitative Research

UX research methods are usually divided into quantitative and qualitative methods.

- Quantitative user research methods measure user behavior numerically and usually answer the “what.” They answer questions like, “how many people liked this product” or “what percentage of customers used this product daily?”. These are valuable insights, revealing trends in consumption and what is happening. Multiple-choice survey questions are examples of quantitative research tools.

- Qualitative user research methods, or soft research, are contextual in nature (text, observations) and seek an in-depth understanding of the user experience by answering the “why.” They answer questions like, “why do you use this product?” or “what else do you use this product for?”. These help explain why customers act in particular ways. One-on-one customer interviews and open-ended survey questions are examples of qualitative research tools.

Both quantitative and qualitative methods have their strengths and weaknesses. Quantitative methods scale better, but have a higher likelihood of false positives. Qualitative methods offer better insights but are harder to collect at scale.

Their use often depends on the goals of research and practical concerns such as budget, time available, number of hands on deck, and KPIs you need to hit.

There’s no doubt that the most effective user research uses a combination of quantitative and qualitative methods. For example, one-on-one user interviews can be followed up by a survey to better understand how the findings correlate with a larger sample size.

What is Actionable UX Research?

At its core, user research is about gathering, sharing, and using contextual evidence about user/customers to drive better business decisions.

If you’re ready to uncover the actionable insights sitting beneath UX research, you’ve come to the right place.

Actionable UX research is about approaching UX research with a focus on the methods that provide the most actionable insights to the broadest group of stakeholders, balanced against speed to execute.

Most UX research teams rely on a variety of research methods, from ethnographic studies to contextual inquiry to one-on-one interviewing. All are useful and valuable, but some methods provide more actionable information than others, especially for those working in a non-research role.

Of course, there is a huge crossover between “traditional” UX research and more actionable UX research. Both rely heavily on methods like user interviews, surveys, and usability testing.

But in this guide on actionable UX research, we want to introduce you to a few more actionable methods—the ones that aren’t often discussed in traditional UX content, like support ticket transcripts, Google search intent analysis, and UGC mining.

UX Research Generates Insights, But Also Creates Critical Context

While this deserves a more thorough overview, good UX research has two key goals: (1) create context; and (2) turn research data into valuable insights.

Of the two goals, insight is most often connected to UX research. (Just in case you’re curious, an insight can be defined as, “actionable, data-driven findings that create business value.”)

But for researchers, the act of doing the research itself creates context that can be invaluable when viewing and acting upon insights — context that can get lost in translation when sharing results with those not directly involved in the research.

In other words, if you’re only reading research reports and not actively participating in research, you will always miss some of the context.

To combat this, it’s better for as many individuals within a company as possible to do UX research. Even if you have a UX research team, everyone should be at the very least be trained on the basics. That’s one of the reasons we wrote this guide.

And if you are the one doing the research, try to remember to create context and color when sharing insights with your bosses, colleagues, or other stakeholders. Tell stories and bring your research insights to life with the use of quotes, actual photos, audio snippets, and video clips.

Popular Actionable UX Research Methods:

- User Interviews

- Surveys

- Remote Usability “User” Testing

- Onsite/In-App Polling

- Live Chat/Support Ticket Transcript Analysis

- Google Search Intent Mining

- User-Generated Content Mining

- User Session Recording

- Facebook Audience Insights

This beginner’s guide will help you learn the things you need to avoid the costly pitfalls associated with doing the wrong kind of UX research, by breaking down some of the most common methods of actionable user research. Take it as an introductory course on actionable UX research, UX research methods, and proper application.

1. User Interviews

One-on-one user interviews are the gold standard for user research.

Because of their exploratory nature, they provide critical data on evolving customer needs and are one of the best risk mitigation strategies companies have when it comes to “unknown unknowns” about their customers.

“It ain’t what you don’t know that gets you into trouble; it’s what you know for sure that just ain’t so.” — Mark Twain

In the ever-changing and hectic paced world of a fast-growing company, it’s easy to misclassify assumptions as facts and use assumptions, rather than facts, to drive big and small decisions.

A series of poor decisions can lead to everything from missing growth targets (as is often the case) to complete business failure.

Even the most data-driven teams, extraordinarily diligent in their use and characterization of assumptions vs. facts, often don’t realize they’ve treated facts about their users statically (i.e., it will always be true) as opposed to dynamically (i.e., we need to check if it’s still true).

User interviews are one method to consistently help:

- Produce and maintain more accurate assumptions;

- Catch yourself from using an assumption as a fact; and

- Turn more assumptions into facts.

Moreover, one-on-one user interviews discover emotional and psychological insights motivations behind customer behavior and what customers actually want (hint: it’s not usually what they tell you).

User interviews help answer questions like:

- Who are our customers and what are their biggest problems?

- What is the context that surrounds our product?

- What is our customer’s daily life like? What motivates them? What are they scared of? What is “success” to them?

- How are our brand and products used in the customer’s life?

Quality Over Quantity

User interviews are critically important. Even if you do no other user research, do interviews.

This is especially true for startups or smaller companies seeking product-market fit when your “unknown-unknowns” are the highest they will ever be.

The sheer amount of insight collected from a 30-minute interview with one customer is far better than one line responses from 50+ customer surveys.

We’d even stretch that as far as 100 customers. Perhaps even 1,000.

When it comes to actionable user research and one-on-one interviews, people often obsess over sample size. Yes, sample size is important for reliable and accurate data. But even five user interviews, while certainly not statistically significant, is better than 0.

When it comes to qualitative interviews and sample size, there isn’t a generally agreed-upon standard even in the academic world, let alone the business world where user research is still finding its norms and best practices.

If the interviews are done before a big business decision (let’s say before designing and launching a new product), you should be more diligent on sample size.

We often recommend 20-30 interviews per customer segment as a good sample size. That being said, you can often see patterns and trends from just 12-15 interviews per segment.

Recruiting Interviewees Outside Your Company

Interviewing your own customer/user base is preferred, but there are times when it’s necessary to interview third parties, such as when:

- You are developing a new product and have no customers yet;

- You don’t have enough customers to interview for a decent sample; or

- You need the POV of individuals who are not yet customers/users.

There are many ways to recruit people outside of your company to interview, but the easiest is to turn to a platform like userinterviews.com or to recruit from your/your company’s personal networks.

Cons of User Interviews

It’s worth acknowledging the downsides of user interviews.

Conducting user interviews is time-consuming. There’s no way around it. Interviewing, transcribing, analyzing, and reporting requires time (although the right strategy and systems will help lessen the time burden and increase results).

At the same time, user interview responses are highly dependent on the skills and subjectivity of the interviewer.

Nevertheless, user interviews are still a fantastic way to collect insight from the user.

Helpful Tools & Resources

- Start here with this comprehensive guide to customer interviews

- Calendly

- Zoom

- Rev.com

- Enjoy

- Excel

- Nvivo

- UserInterviews.com

2. Surveys

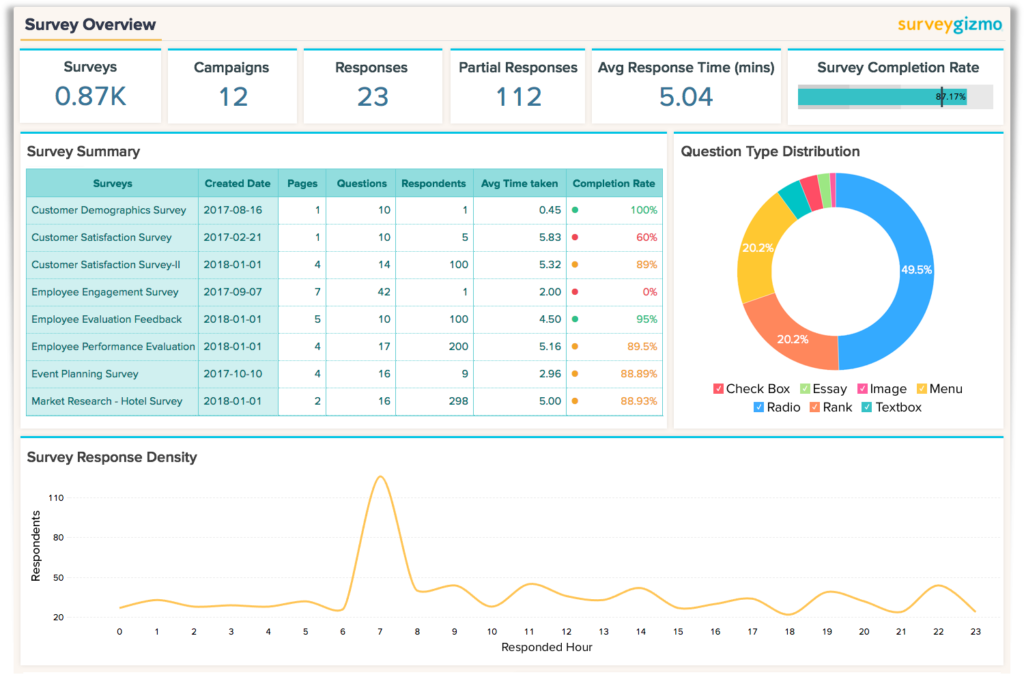

Image Source: Zoho

Surveys can collect both quantitative and qualitative data fast. A survey can be designed and deployed in a few days, making this a popular UX research method for smaller companies.

Online tools like SurveyMonkey, Survey Gizmo, and GetFourEyes can collect thousands of responses easily and often at a low cost.

Surveys help answer questions like:

- What competitive products/alternatives do our customers use?

- Are our customers satisfied?

- What are their relative value/feature preferences?

Surveys are a great tool for researchers, as no other method can provide such a significant amount of information from a large population of customers as fast.

The results are also more statistically significant than other methods, as inferences are drawn from a wider range of participants with a broad range of attitudes, opinions, and behaviors.

Surveys are also relatively easy to administer outside of your own user/customer base (although often pricey) by using third-party market panels. Good options for consumer panels include Google Surveys and Ask Your Target Market. B2B is trickier, but Dynata is a good option with a broad choice, as long as you’re prepared to pay.

Many popular survey platforms, like SurveyGizmo and Survey Monkey, also allow you to choose from existing panels of people ready to take a survey.

Good surveys are, unfortunately, notoriously difficult to design. Researchers and survey designers must consider a variety of factors like survey fatigue, question order, user experience, and question design and phrasing.

If you haven’t done user interviews first to reduce your risk of unknown unknowns, surveys can easily give you false positives. And acting on bad data thinking its good data is often worse than acting on no data at all.

Despite such difficulties, surveys are still standard tools to gather actionable user research fast.

Helpful Tools & Resources

- Start here with this thorough guide on designing, iterating, and analyzing surveys

- SurveyGizmo (best all around)

- SurveyMonkey (most common)

- Get Four Eyes (best all-around free option)

- Google Surveys (consumer panels, all around cheapest option)

- Dynata (B2B & health panels)

- Ask Your Target Market (consumer panels, better targeting, some automatic survey analysis)

3. Remote User Testing

Remote user testing allows you to conduct research with customers in their natural environments—such as at home or work—through the use of remote user testing software.

While remote user testing doesn’t replace in-person usability tests or field studies, they are a great compliment to those UX research methods and are fast to run. Complete user tests can be returned in less than 24 hours.

Typically you can run a remote user test in three places:

- Website/SaaS

- Mobile apps

- Prototypes

In a remote user test, the tester is asked to complete tasks set out by you while sharing their screen and sharing their thoughts out loud. Most tools have a willing panel of testers to select from, and many listed here will also allow you to provide your own testers for an additional cost.

Our go-to is usertesting.com, where you can run your first 15 remote user tests, selecting from their thousands of ready-to-go panelists, for $50 per video.

Remote user testing is a great option for:

- Understanding which aspects of your website, web app, and/or mobile app’s UI/UX are poor

- Testing new design prototypes

- Finding critical conversion problems in your signup and/or checkout flow

- Understanding buying behavior, particularly how people research products like yours online

- Axing confusing and conversion-killing messaging + copy

- Improving onboarding and activation rates

- Understanding how users compare you to competitors

For many of the use cases listed above, you can run a test on your own product/website or your competitors’ products/websites. This goes over particularly well with executives and founders who are always eager to size up the competition.

Sample sizes when running remote user tests don’t need to be large. Getting 15-20 user testing videos is a waste. It’s better to do multiple, but small, rounds of testing with anywhere between 3-6 tests each.

The primary benefit of remote user testing is realism and speed. Participants are not in artificial or unfamiliar test settings, leading to more realistic behavior, reactions, and opinions.

Any contextual information collected is also important, as the researcher might observe other important behaviors related to how the product or service is actually used.

Cons of Remote User Testing

Like surveys, the success of remote user testing is dependent on the researcher’s skill. Inexperienced researchers might inadvertently provide too much direction or miss important behavior, generating flawed data.

You also don’t need to be a trained researcher to run remote user tests, but you do need to educate yourself on the basics, such as writing screeners (how you select testers) and designing non-biasing questions.

Helpful Tools & Resources

- Start here to get more familiar with remote user testing

- UserTesting.com

- Usability Hub

- User Zoom

- Validately

- Userlytics

4. Website/In-App Polling

Image Source: Qualaroo

The following are less conventional research methods but are increasing in popularity due to ease, scope, and accuracy of data collection. As you will notice, many are online methods.

As companies increasingly rely on online platforms to organize, advertise, and communicate, the internet has turned into a data goldmine. In addition, these methods have plenty of upside with little comparative downsides.

Polling methods are most commonly seen in the world of politics; however, website/in-app polls have become more and more popular in the business world as well. Today, you can pose a simple one-question survey with a handful of answer options and get data fast, directly from your own website visitors/users.

When would you use an onsite/in-app poll as opposed to a survey?

- When asking a question after-the-fact (like with a post-purchase survey) would lead to memory issues and less accuracy. For instance, asking how someone found your website, if the website page met their needs, or what almost stopped them from buying/signing up will all get more accurate answers if asked around the time the action took place.

- When complementing or substituting a survey. If you worry you won’t get enough responses on a survey from your own users/visitors, or you only have 1-2 questions to ask, onsite/in-app polls can be a better option.

Flexibility, cost, and easy application are all benefits of onsite/in-app polling.

It takes little effort and tech-savvy to deploy an in-app/on-site poll, and it’s easy to pick who will see the poll and where. At the same time, website visitors can respond with minimal effort.

Many of the guidelines from surveys apply to polls because polls are, in fact, just one- or two-question surveys. Hotjar and Qualaroo are great options for setting up and deploying on-site or in-app polls.

Helpful Tools & Resources

- Start with this explanation of the benefit of social media polls can benefit you

- Then read this guide to customer feedback surveys

- Qualaroo

- Hotjar

5. Live Chat and Customer Support Transcripts

Image Source: pickSaas

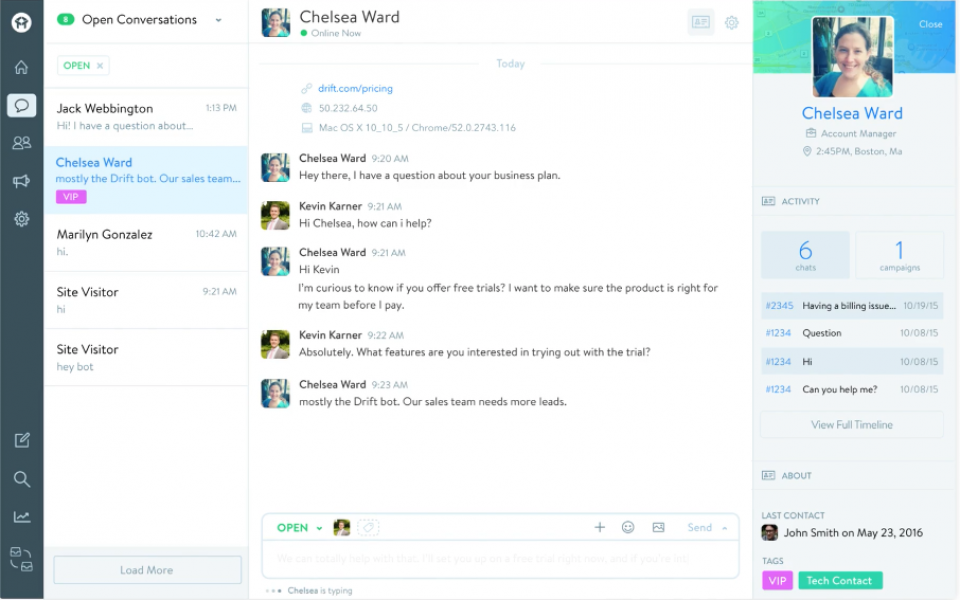

Live website chat using tools like Drift and Intercom and help desk software like Zendesk or HelpScout are popular components of many companies’ sales and customer support operations.

Not do they help companies provide just-in-time customer service and sales answers, but live chat and help desk transcripts hold powerful insight into problems customers/prospective customers face and where the UX/UI is confusing.

Live chat transcripts are great for understanding:

- What is missing, confusing, or unclear on your website

- Why a visitor didn’t convert

- How a visitor views your product compared to a competitor’s

- What market category they think you’re in

Live chat and help transcripts are nuggets of data gold, where common questions and opinions highlight potential areas of improvement. In particular, these transcripts help prioritize product roadmaps and increase conversion rates.

One of the easiest ways to get started with using live chat and help tickets for user research is to apply the spotlight framework to help categorize and prioritize insights.

You can do this manually, of course, but a customer research tool such as Enjoy allows you to automatically pull your transcripts from popular chat/support tools and set up rules to have them auto-categorized according to frameworks (like spotlight) which you can mine for gold later.

One issue to be cognizant of is paying close attention to whom the transcript you’re analyzing is from. Is it a paying customer? A free trial customer? A prospective customer? A churned user? The data need to be adjusted and weighed based on who’s saying it.

Helpful Tools & Resources

- Start here to learn more about live chat transcripts as a user research method

- Enjoy

- Drift

- Intercom

- Spotlight Framework

6. Google Search Intent Mining

Image Source: The Keyword

Search engine optimization (SEO) involves making sure the content you’re putting out online is optimized to be visible to search engine users. If people are searching for your product online (or information about it), SEO is an important form of user research.

Google is a great tool for understanding the intent driving how your users search for your product, or your competitors’ products, online. Their search results, suggested searches, and related searches can give you important insight into a searcher’s intent, so you can deliver better SEO and content. After all, you shouldn’t be putting out targeted content without first understanding the searcher and their motivations.

Google search intent mining is great for understanding:

- What is driving users to search for a specific piece of information aka the “why”

Come up with a list of search terms that people may use if they are looking for your product and do your own Google search (preferably in incognito mode, so Google doesn’t over-personalize your results). Take a close look at the search results for each and try to identify the intent to position ratio.

Search results near the top (not including ads) give you an indication of the most popular type of content searchers are clicking on, providing a clearer picture of searcher intent. Remember to also look at the “related searches” box at the bottom of the page, as they can offer more clarity on searcher intent.

You should also look to see whether Google is ranking images or videos at the top of organic results. Image rankings indicates you should be doing image SEO, while videos imply you have a potential YouTube audience for your product. Similarly, if top results are coming from Pinterest (likely in visual-heavy markets), be sure to do some Pinterest SEO.

Helpful Tools & Resources

-

- Start with Moz’s ‘White Board Friday’ lesson on this topic

- Google (Obvious, we know)

7. User-Generated Content (UGC) Mining

UGC refers to any type of content that is created directly by current and prospective customers/users. When products are featured in UGC, users are essentially giving them a vote of confidence. It’s basically free marketing, with the bonus of trustworthy social proof.

But, UGC is also of interest to user research as it is an important source of data.

UGC mining is great for understanding:

- How much do our customers enjoy our product or service?

- How is our product viewed or consumed by customers?

- How marketable/popular is our product or service?

- How do our customers react to our services and products?

- Where are some gaps in our services and products where we can improve?

Business blogs can also be great generators of UGC, and are an easy source of “free data.” They can allow you to connect with your users through relatable content, with blog comments and other feedback (such as traffic or number of shares) offering a source of customer insight.

Helpful Tools & Resources

- Start here to read more about UGC and its benefits

- Read this for a practical approach to content analysis (for mining blog comments, etc.)

- Your company/product reviews (on your website, Yelp, Google, Amazon, Trip Advisor, Trust Pilot, G2Crowd, etc.)

- Blog comments

- Social media

8. User Session Recording/Heatmaps

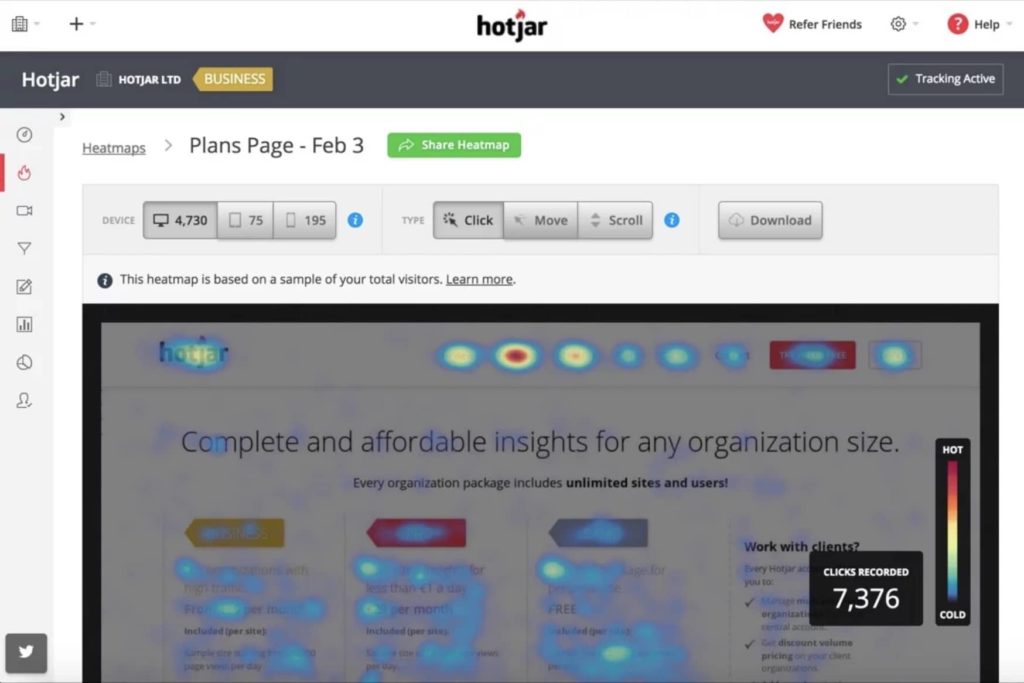

Image Source: Hotjar

User session recordings are recordings of real actions taken by your users as they navigate your website (or app or other platform). It’s the closest you can get to watching users on your website without physically peering over their shoulder.

Videos of user session recordings, which can be collected using tools like Hotjar and Fullstory, record everything in your user’s browser, including mouse movements (on desktop), scrolling, clicks or taps, multiple page views, and even keyboard strokes.

This type of user research helps you spot trends across users and issues that are standing between you and conversions. Recordings can give you insight into your typical user experience and how you might be able to optimize it.

User replays/recordings are great for understanding:

- Where users get stuck (causing them not to convert)

- Where they focus most of their time

- How they interact with website elements

- How they navigate through your website

- Any hidden bugs and obstacles

- What frustrates them

- When users leave your website (and sometimes why)

Analyzing these user sessions to uncover actionable insights requires a structured approach, so get clear on why you’re watching them in the first place. Is it to find bugs? To see where you’re losing conversions? Then watch your replays with that goal in mind, filtering your recordings accordingly to avoid wasting time.

Helpful Tools & Resources

- Start with this definitive guide to session replays

- Hotjar’s guide to session recordings

- Hotjar

- Fullstory

9. Facebook Audience Insights

Image Source: Hootsuite

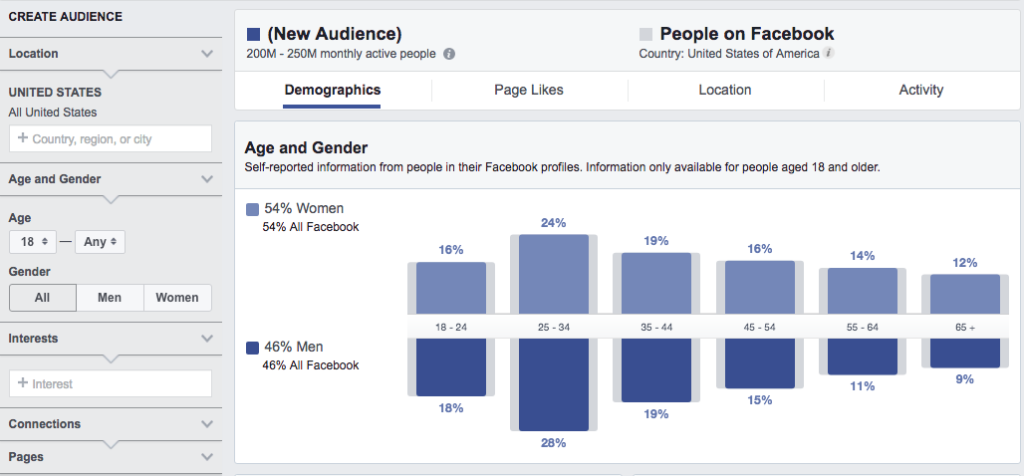

The Facebook Audience Insights tool gives advertisers a way to access collected data from self-reports by users and matched third-party data partners – making it a great tool for market research.

We hesitated about whether to include this as a user research method because, while it does provide some exploratory insights, they don’t go deep. Facebook insights also have accuracy issues and can sometimes be seen as “candy,” whereas the other methods we’ve detailed here are more like “diet and exercise.” In other words, this method has a habit of diverting attention from the real work.

Nonetheless, Facebook insights can be helpful when used in a strictly exploratory manner when combined with one or more of the other research methods we’ve discussed.

Data provided by Facebook insights includes demographic information, lifestyle, and interests, data shared on profiles, the type of groups joined, and so on.

Facebook audience insights are great for understanding:

- Are there any competitors or competitive alternatives we hadn’t realized?

- What other products/services/pages do our users follow? Are they following our competitors?

- What factors/businesses/figures might influence our users?

- How do our data in areas prone to inaccuracies (like income level) compare to Facebook’s data?

While this data is useful, if you’ve ever looked at your own profile to see how Facebook has pegged your personal data for ad purposes (a fun exercise that is equally entertaining and frightening), you’ll see that it’s often only 50% right. The Washington Post did well shining some more light on these data points.

We highly caution using Facebook Audience Insights beyond an early exploratory exercise and don’t recommend relying on this data unless you’re specifically doing Facebook ads research. However, it is a good method for unearthing potential interests your users may have and competitive alternatives you may not have realized.

Helpful Tools & Resources